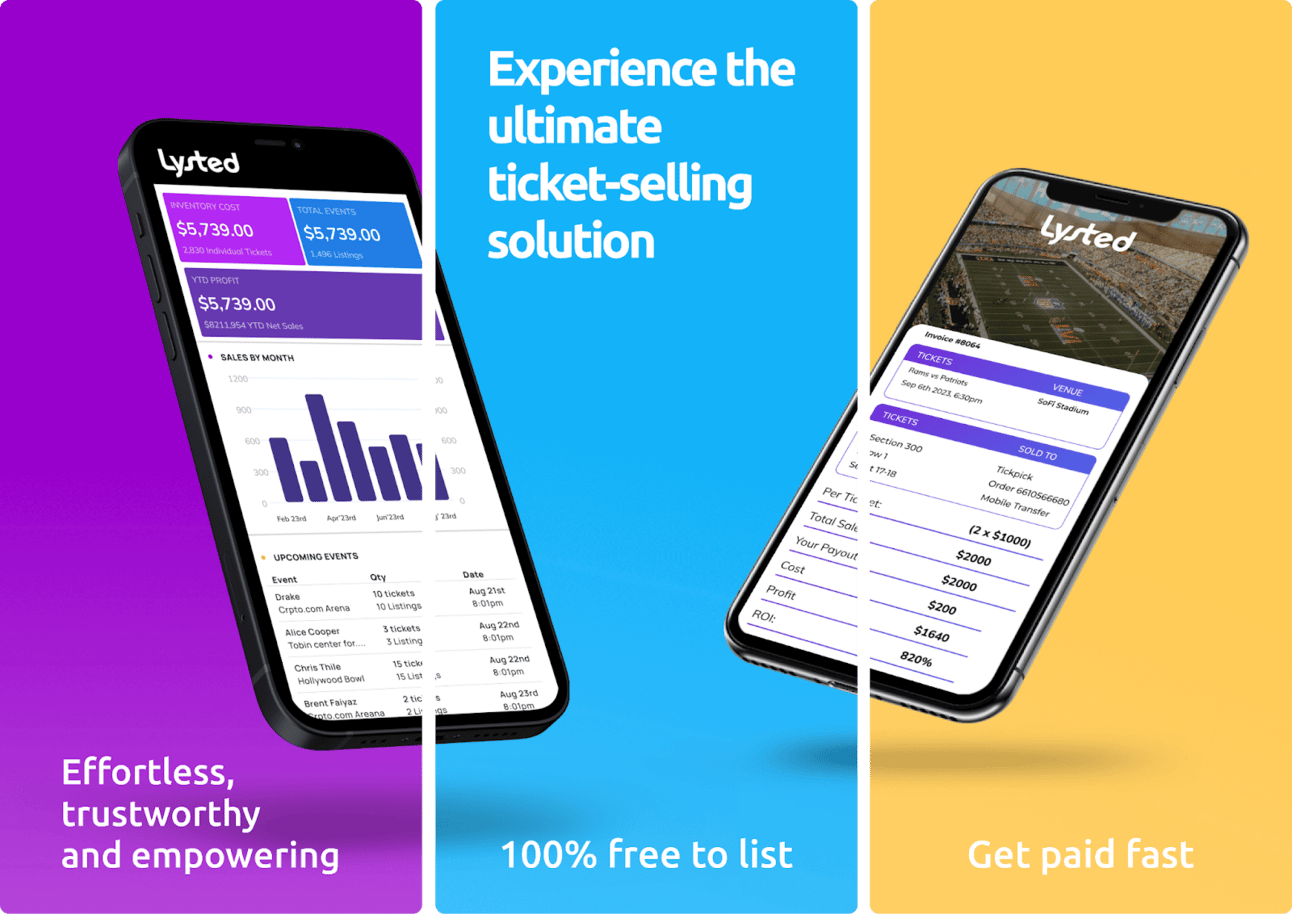

Make Extra Cash Reselling Tickets with Lysted

Looking for a new side hustle to boost your income? Don't let unused concert tickets go to waste—turn them into cash with Lysted!

Lysted's advanced pricing tools ensure you get top dollar for your tickets, making it easy to maximize your profits. With just one listing, your tickets are available on major platforms like StubHub, Ticketmaster, and Seat Geek, saving you the hassle of managing multiple listings.

Plus, Lysted offers fast payouts, getting your earnings directly into your bank account within weeks. It’s a smart and simple way to make extra cash on the side.

Summary -

Explore a variety of funding opportunities for veteran entrepreneurs to kickstart your business journey. From grants like the Veteran-Owned Small Business Program, StreetShares Foundation, and Warrior Rising to loans such as SBA Veterans Advantage and Military Reservists Economic Injury Disaster Loans, there are numerous options to support your venture. Prepare thoroughly, understand eligibility requirements, and tap into mentorship resources and networks for success. Whether you’re building the next tech innovation or starting a neighborhood café, these funding opportunities can help turn your vision into reality. Ready to take the leap?

If you’ve served your country and now dream of launching your own business, you’ve come to the right place. Let’s explore the variety of funding options available to help you achieve your entrepreneurial goals. From grants designed for veterans to other financial resources, we’ll break it all down. Whether you’re building the next tech innovation or opening a local café, there’s funding available to make your vision a reality.

Understanding Funding Options: A Brief Overview

Before embarking on your business journey, it’s essential to familiarize yourself with the funding opportunities available to veterans. These resources can provide the financial boost needed to start a new venture or expand an existing one.

Types of Funding Available

Grants: These are essentially free funds that don’t require repayment. However, they’re highly competitive and come with specific criteria.

Loans: Loans must be repaid with interest, but they’re often more accessible and customizable to meet your business’s needs.

Angel Investors: Private investors who provide funding in exchange for equity or convertible debt in your business.

Top Grants for Veteran Entrepreneurs

Here’s a selection of grants that cater specifically to veterans:

1. Veteran-Owned Small Business Program

This federal program ensures that veteran-owned businesses have access to contracting opportunities with government agencies. To qualify, your business must be majority-owned by a veteran and meet other eligibility criteria.

This nonprofit offers grants through its Military Entrepreneur Challenge, with awards ranging from $4,000 to $15,000, along with added benefits like complimentary legal services.

3. Warrior Rising

This organization supports veterans transitioning into “vetrepreneurs” by offering grants, mentorship, and a structured business development program.

4. The Second Service Foundation

Formerly the StreetShares Foundation, this organization runs the Military Entrepreneur Challenge, offering grants for veteran entrepreneurs with innovative business ideas.

5. Grants.gov

An extensive federal grant database, Grants.gov is an invaluable resource for finding funding opportunities tailored to your needs.

Loans and Other Funding Options for Veterans

If grants alone don’t meet your financial needs, consider these additional funding options:

1. SBA Veterans Advantage Program

This program offers reduced fees on Small Business Administration (SBA) loans, making them more affordable and accessible to veterans.

2. Military Reservists Economic Injury Disaster Loans

These loans are designed to help businesses that experience financial hardship when a key employee is called to active duty.

3. Online Business Loans

Offering faster processing and more flexible terms than traditional bank loans, these loans are a convenient option for veterans.

Tips for Applying for Grants and Loans

Confirm Eligibility: Ensure you meet all the requirements before applying to save time and effort.

Gather Your Documents: Submit complete and accurate documentation within the specified deadlines.

Develop a Clear Business Plan: A strong business plan will articulate your vision and demonstrate your need for funding.

Leverage Mentorship Resources: Organizations like the Veteran Business Outreach Center offer valuable guidance and support.

Connect with Fellow Entrepreneurs: Engage with other veteran business owners to gain insights and learn from their funding experiences.

Final Thoughts

Starting a business as a veteran can be both exciting and challenging, but with the right resources and determination, you can turn your vision into reality. By exploring all available funding opportunities, preparing diligently, and seeking guidance when needed, you’re setting yourself up for success.

Whether you’re dreaming of launching the next tech startup or creating a local business to serve your community, countless opportunities await. Now is the time to channel your entrepreneurial spirit and take that leap. So, what’s your next move? Let’s turn those business dreams into reality!

Recommended Experts and Mentors

Follow and subscribe to become a member to get the content, community, and mentorship you need:

Step-by-Step Guides

Enroll in these guides to build and master your side hustle. All our guides are created by vetted and proven experts:

Get Started with Graphic Design by LaDale L Whaley

Find the Best Online Business to Start by The eCommerce Mom

29 Side Hustles You Can Start With Less Than $10,000 by Arthur Wang

Recommended Tools

Check out these cool tools that will help you get going today:

FREE Side Hustle E-Book!

Start Your Side Hustle Success Story — Get your FREE E-Book guide now!